[Updated 9/3/19, see update notes at end

--the 9/3 update on corporate-customer matching funds is especially notable]

We are at a crisis in our view of the role of business in society, as highlighted in front page stories last week. But I suggest both sides of this long-running debate misread the underlying issues. My work points to a new perspective, one that suggests a "reformation" of market capitalism. This is based on a new

co-primacy of customer power that will make most reasonable people on both sides happy...

And here we are. Americans mistrust companies to such an extent that the very idea of capitalism is now being debated on the political stage.

So

Andrew Ross Sorkin observed in the NY Times, applauding the Business Roundtable's 8/19 "

Statement on the Purpose of a Corporation," calling it "a significant shift, and a welcome one." Many others applauded -- but as Sorkin and others noted, there is still good reason to be skeptical of any real change.

On the surface, the Rountable statement may seem pretty mild: "We share a fundamental commitment to

all of our stakeholders." But things are hardly that simple.

The Council of Institutional Investors (CII) came out expressing strong concerns:

It is government, not companies, that should shoulder the responsibility of defining and addressing societal objectives with limited or no connection to long-term shareholder value.

While it is important for boards and management to have and articulate long-term vision, ...a fundamental strength of the U.S. economy has been and continues to be efficient allocation of equity capital. If “stakeholder governance” and “sustainability” become hiding places for poor management, or for stalling needed change, the economy more generally will lose out.

Since the CII represents "primarily pension funds, state and local entities charged with investing public assets and endowments and foundations," one would expect them to have relatively enlightened view of the shareholder interest.

The WSJ editorial board was so apoplectic they did lead editorials two days in a row, the second quoting the 1970 article “

The Social Responsibility of Business is to Increase its Profits” by Milton Friedman of the "Chicago School" of economics (in The NY Times!) that many blame for the current malaise.

(It also seems that the

current legal framework for corporate governance and fiduciary duty to shareholders limits the discretion of corporations to fund social responsibility: "a decision by a board that is not grounded in the best interests of the corporation and its stockholders likely would not be protected by the business judgment rule under the current state of the law.")

The dilemma here can be resolved by recognizing that it is not shareholders alone, but customers who share primacy. Customers are the stakeholders who actually fund the costs of social responsibility, and they have the market power to influence the allocation of those costs (or take their business elsewhere).

==================================================================

The Ideas in Brief

- Concern -- and confusion -- about whether and how market capitalism can have social responsibility is reaching a crisis point.

- An exhorted responsibility of shareholders to be beneficent to other stakeholders (customers, employees, suppliers, community,...) can have only limited and uncertain effectiveness -- even if CEOs truly wish to be more beneficent.

- Customers have the prime authority, since the funding comes from the customers. Social responsibility is ultimately a "tax" on the customer. To be "represented," each customer should be able to vote with their wallet on how much tax they pay, for what.

- Businesses now have new powers to involve each customer in mass-customizing the service value propositions that they pay for -- including payments for Social Responsibility as a Service (SRaaS).

- That will apply the genius of the market -- enabling businesses to profit from being socially responsible as each customer supports. Think of it as a social responsibility tax that each customer agrees to pay -- at an individualized level that both parties agree is fair for that customer.

Very basic examples of SRaaS offers: [Added 8/28]

- Would you be willing to pay an extra $4 for environmentally-friendly, biodegradable packaging and no-fossil-fuel shipping?

- Matching grant: Would you be willing to pay an extra $1, $5, or $20 (select amount) to fund on-the-job training for ex-coal miners who seek to upgrade their skills to work in our factory in Appalachia, if we match your grant dollar for dollar? [revised 9/3]

- Do you want to rank your product search results 1) by price alone, 2) by price weighted by ESG score, or 3) by ESG score alone?

- Do you want to filter your product search to require an ESG score of greater than 1, 2. or 3 stars?

==================================================================

Oversimplifying the problem

There has been a long history of contention (and confusion), and I suggest the issue is not so much a matter of what capitalism is inherently, but of simplistic thinking about how it works. As Sorkin recounts,

For nearly 50 years — following the publication of a seminal academic treatise in 1932 ... — corporations, for the most part, were run for all stakeholders. It was a time defined by organized labor, corporate pension programs, gold-watch retirements and charitable gifts from companies that invested heavily in their communities and the kind of research that promised future growth.

That came to be seen as muddle-headed and inefficient, and Friedman forcefully argued that a business's only duty was to serve its stockholders. Now that view is in growing disrepute -- but the truth is not so black and white.

The Business Roundtable had said in

1997 (as recounted in

Quartz) that “The paramount duty of management and of boards of directors is to the corporation’s stockholders.” Now their new statement changes this, to affirm "a fundamental commitment to

all of our stakeholders," listing them in this order: customers, employees, suppliers, communities, and shareholders. Some are pleased to see shareholders listed last, some incensed. But others point out that it is not clear 1) whether this has any real operational meaning, and 2) what might actually change, or how.

Making sense of the stakeholders and how they are served

My work on how the digital world changes business relationships provides a new perspective that cuts through much of this confusion with a powerful new simplicity (see

my book and/or

this post).

It all comes down to the operational roles of the different stakeholders. We have customers, employees, suppliers, communities, and shareholders. We also have managers, who may be the shareholders, but often are the representatives* of the shareholders. Clearly, the shareholders own the business, and the managers are hired to be the shareholders' representatives*. The owners have power because our whole system of private property-based capitalism gives owners special rights.

[*See 8/27/19 update below on the agency theory of corporate ownership.]

There have always been critiques of this system, including communism, socialism, cooperativism, and many other variations on shifting ownership/control of the means of production to other stakeholders. But before we throw the baby of market-based capitalism out with the bathwater of its abuses, let's look deeper.

The question is how shareholder's rights interplay with the rights of the other stakeholders, and that is where it gets interesting.

Those who favor market capitalism argue that its genius is that the market creates value with the economic efficiency and emergent wisdom of Adam Smith's invisible-hand of the crowd -- something that other systems are unable to match. Whether you approve of Friedman or not, it is worth reading his 1970 article to understand the mechanism he describes.

I think Friedman oversimplifies how the stakeholder interests interplay, but much of his core argument about how profit-driven market mechanism work is valid, and many critics fail to understand how hard it is to make sound economic decisions without profits as an incentivizing and score-keeping mechanism. Friedman and the CII are right that the Business Roundtable statement offers no meaningful operational guidance to the hard questions of how competing interests are effectively and fairly served.

The co-primacy of the customer

Without customers there is no business. The central role of business is to create value by selling services to customers. Doing that effectively produces revenues, and hopefully some profit, both of which enable the business to continue to create value by selling services to customers. Other stakeholders may be more or less important (sometimes very important), depending on context, but none have as fundamental a role in making a business work.

Businesses can do well by doing good. To the extent a business successfully creates value and obtains revenue from customers, it can share that value (in the form of revenue) with the other stakeholders. Properly managed, it can pay employees and suppliers, and support its community. Good management recognizes that creating and sharing that value enables the creation of more value.

But the only money that comes in is from customers. No value can long be created or shared, except as funded by customers, who pay for the what they value.

You forget one thing, Milton!

Milton Friedman was right, up to a point:

What does it mean to say that the corporate executive has a "social responsibility" in his capacity as businessman? ...the corporate executive would be spending someone else's money for a general social interest. Insofar as his actions in accord with his "social responsibility" reduce returns to stockholders, he is spending their money. Insofar as his actions raise the price to customers, he is spending the customers' money. Insofar as his actions lower the wages of some employees, he is spending their money. ...if he does this, he is in effect imposing taxes, on the one hand, and deciding how the tax proceeds shall be spent, on the other.

But what Friedman seems to forget is that the customer has a say in how much they pay, and will take their business elsewhere if the price does not map to the value they perceive that they get.

- If the customer will not pay a "tax" to support whatever level of "social responsibility" to other stakeholders they see as desirable and fair, no tax is received.

- If the customer willingly allocates part of the price they pay to such a tax, shareholders will be fine with that.

- If the customers refuse to allocate any payment for social responsibility, shareholders will not be able to sustain paying to share that value with other stakeholders.

No amount of exhortations to "social responsibility" can change that fundamental reality. Friedman knows that shareholders control the business, and that they do not want to pay an unnecessary tax, but he forgets that the customer may be more than willing to do so, and may go elsewhere if stymied in doing so. It is ultimately the customer, not the shareholder who pays the tax.

Why should we expect the shareholders to spend money on social responsibility unless the customer is willing pay for it? The question is what level of tax will each customer pay, to be spent on what kinds of "social responsibility?"

This is what the FairPay framework is focused on, as outlined in my blog, and in two journal papers co-authored with eminent marketing scholars (

one suggesting where digital business is going, and

one digging deeper into its human roots).

A new precision in individual consumer power

This is something entirely new -- a new precision in consumer power, to be applied at the individual level for individual ends. We already see growing consumer power in boycotts and social media, but those are very blunt instruments, with little more wisdom than a mob (and generally reactive, not proactive).

When computer-mediated dialogs and AI work with each customer to decide specifically what to offer to them and what price to accept from them, this can become an effective commercial layer of digital democracy about precisely what social responsibilities the business fulfills --

working as a representative* of each customer and their individual values. That is the theme of this post.

First, some perspective -- look back at the history of how humans behave as commercial creatures. We naturally think about the norms of commerce as we experience them, but we are locked in the anomalous mindset of recent decades.

Traditionally commerce was dominated by local economies of individuals and small groups who had long-term relationships with those they traded with. It was natural to view value broadly, to consider the human dimension of the value of goods and services, and their impact on the local stakeholders. Traders who failed to consider their stakeholders did not thrive.

Behavioral economics has rediscovered in the past few decades that people are social creatures. They have an inbred desire to cooperate, to value fairness, transparency, reciprocity, and even altruism, and they are swayed by emotion and self-image. They refer to this as

homo reciprocans (reciprocating man). That is in contrast to the older narrow conception of classical economics, of

homo economicus (economic man), who acts purely in his rational self-interest. Commerce was very communal, and people evolved over many millennia to develop and thrive on the traits for cooperation and trust that supported that.

That direct connection was lost as business scaled to mass production in factories, and mass-marketing in department stores. Instead of individually negotiated prices, prices were pre-set, take it or leave it. Customers became just numbers, not people. Businesses became alienated from their customers and both lost sight of this dynamic of win-win co-creation. Short-term profit became decoupled from long-term sustainability, managers optimized what was easy to measure, and stockholders became fixated on this simple zero-sum game of quarterly profits. There have been ups and downs, but the overall trend has been a devolution of the human center of commerce.

But over the past decade or so, modern marketing has realized that there is a longer game of customer journeys, loyalty loops, and recurring revenue (especially subscriptions and memberships) that it is measured by customer lifetime value (CLV), not current-period profit. That longer game enables a business to grow sustainably and become even larger and more profitable. Digital customer relationships and digital services are enabling and fueling a re-awakening of more traditional business norms, but we have

not really understood where it will lead.

The Age of the Customer

Forrester has called this

The Age of the Customer (emphasis added):

In this era, digitally-savvy customers would change the rules of business, creating extraordinary opportunity for companies that could adapt, and creating existential threat to those that could not. ...In this new world, companies have struggled to make hard choices and act. It requires leaders to think and act differently – in ways that feel foreign, unfamiliar, and counter-intuitive. And honestly, it is simply hard to do. ...These dynamics will endure as new technologies like artificial intelligence and robotics emerge to challenge core notions of what it means to be a company, what it means to build human capital, and what it means to compete and win.

Businesses like Amazon and Apple and startups like Warby Parker already profit by delighting the customer, and by listening to what the customer values. FairPay shows how this can go much farther, so that businesses can shift their offers to mass-customize them to what each customer values and is willing to pay for.

That shift can undo the negative, zero-sum turn of the last century, and show companies how to profit from more win-win relationships with their customers. That is where the new leverage is.

- If customers will pay for it, it can generate profit.

- If customers value it, they will pay for it.

- If customers value win-win behavior that benefits not only themselves, but their broader desire to be good citizens, they pay for it, it generates profit, and so businesses profit from that.

That hits the real bottom line, making their stockholders happy.

- To the extent that happens, there is less need for exhortations to consider secondary bottom lines and ESG (environmental, social, governance) criteria that are hard to manage without direct market incentives.

- The genius of the invisible hand will, itself, drive managers to maximize profit by being socially responsible.

FairPay hearkens back to something reminiscent of old-style negotiation, except instead of negotiating

a price for a transaction, we negotiate

a logic for how generously to price over a series of transactions, and what forms and levels of value the price should cover. It is a relationship-based social contract. Much as the invisible hand sets prices to allocate scarcity of supply across a market, FairPay has the effect of

an invisible handshake that sets prices to allocate share of wallet along a relationship.

Each consumer votes with their wallet. As Milton Friedman said, the manager’s responsibility “will be to make as much money as possible while conforming to their basic rules of the society, both those embodied in law and those embodied in ethical custom.”

To do that, the manager will seek to demonstrate whatever level of social responsibility the customers are willing to pay for. The customers will decide how much they are willing to be “taxed,” and what the manager should spend those “taxes” on. [This can get very specific, at an individual level, as explained in the 8/28/19 update below.] The shareholders will want that, and external political mechanisms will be less needed because market mechanisms will do the job.

Social Responsibility as a Service (SRaaS)

Consider how this constitutes a more or less explicit category of service --

social responsibility service, analogous to

customer service.

- In the case of customer service, business used to sell naked products, at the buyer's risk. Gradually they added guarantees and support call-centers and white glove service -- all for a fee (more or less explicit) and often with a choice of options as to service levels.

- Social responsibility service (to other stakeholders) can be similarly customized and funded at different levels by customers, in tiers and sectors. Then it becomes just another service the business can offer to customers who will pay for it. Plenty of behavioral economics assures that customers can be enticed to voluntarily pay for services they value.

Thus every business can offer Social Responsibility as a Service, as a companion service to whatever other services they offer. That can make their customers happier and more loyal -- and they can earn a fair profit for doing it. Smart businesses realize that listening to customers is in their own profit-maximizing interest. We need only exhort both businesses and consumers to focus on more directly effective dialogs about value of all kinds.

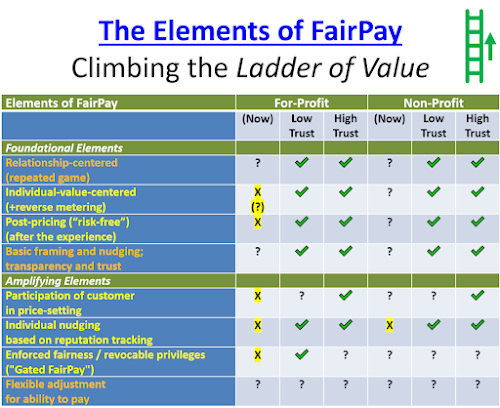

FairPay does this by more explicitly structuring each customer's ongoing journeys as a repeated game that builds cooperation on adaptively customizing value propositions that provide that customer the value they desire at a price both parties agree is fair. It draws on a synergistic combination of elements, each proven individually. It also points to simpler combinations of just some of those elements that can be good enough in many use cases.

>>>>>>For more specifics on just how FairPay does this, see the

>>>>>>"Sidebar: Pricing, FairPay and Allocation by the Customer" (below).

Reforming capitalism from inside

What we need to do, is not to try to heal capitalism from outside (which no one has a good solution to), but to encourage managers to reform it from inside (thus exploiting the genius of market economics). I refer to this as

a reformation because the Protestant Reformation was driven by the realization that what mattered was the relationship between each man and God, with the priesthood as facilitator, not as intermediary.

The Capitalist Reformation will be driven by the realization that what matters is the relationship between each customer and each business, with government as facilitator and guardrail, not as intermediary.

So before we throw out the baby of market incentives with the bathwater of perverse incentives, we should see if the baby of reformed capitalism in the 21st Century can learn to walk with social responsibility. I think we will be very happily surprised.

The challenge is that we are still stuck in our old logic. In an economy dominated by scarcity and uniformity, being responsive to the customer is hard, and done only at the margins. But as the digital economy gains from automation, abundance, and personalized relationships, being responsive and customizing value propositions gets easier and more essential. Businesses are just beginning to understand

the new logic of how to leverage that.

As businesses learn to elicit what each customer values at a fine-grained level, and to seek to deliver it, they will learn to actually profit from social responsibility. As they do that, we will all benefit from the fairness, altruism, and reciprocity of

homo reciprocans, We will awaken their willingness to support Corporate Social Responsibility (CSR) with their own wallets, and to fairly reward the

businesses that cooperate with them in that, working as their representatives.* Friedman’s title will become correct, but just not quite as he understood it: “The Social Responsibility of Business is to Increase its Profits.” The customers will see to directing that properly, using their power of the purse.

Perhaps we should be calling it “Corporate/Customer Social Responsibility.” (CCSR? C2SR?)

==================================================================

SIDEBAR

Pricing, FairPay and Allocation by the Customer

To clarify my points, we need to go back to basics -- pricing. Pricing may seem boring, but it is at the heart of how we allocate resources among stakeholder "actors." The power of pricing calculations to ensure desirable allocations is at the heart of debates over capitalism and socialism. It is also at the heart of FairPay and my points about customer power. FairPay suggests a broad reformation of how businesses relate to their customers, and how we consider all aspects of value, not just social responsibility.

Pricing is where digital changes everything, and that is what FairPay seeks to reform. We are seeing it first for digital services like news and other content. But over time, increasing automation will shift the economics of scarcity for almost everything. Scarcity of materials and labor, and other marginal or variable costs needed to replicate goods and services, was the core of classical economics, but is now becoming a non-issue. The scarcity that remains is increasingly in the human effort to create

new services (and new factories and robots and AI) that then run and

replicate services with little added cost. Adam Smith's invisible hand works by using price to allocate scarce supply against demand -- but

it cannot allocate abundance. That is why we have confusion over what the price of digital information should be, and why we need a new logic for pricing. This new logic is primarily applicable to ongoing relationships, but more and more of commerce is moving from isolated transactions to

recurring relationships.

One early and very telling example is the business of news. Most publishers are still stuck in the old logic – to counter the death of scarcity they seek profit by imposing artificial scarcity, locking their news behind a one-size-fits-few paywall that only their most avid readers can afford. More enlightened publishers (like The Guardian) have learned that readers will voluntarily pay for news (for themselves, as well as for those who do not or cannot not pay) -- just because they value having the quality news available to all. Similarly, creators of all kinds have learned to use crowdfunding services -- and that the seemingly crazy logic of

pay-what-you-want can actually be sustaining. These may seem very narrow markets, but most markets have a blend of elements that are costly and not shareable, and elements that are abundant and shareable.

The repeated game of fairness

The new fairness game that we have outlined shows how this new logic may be applied with increased power and controllability, in a way that works for both the business and the customer. Consider how we can change the game for a subscription, from:

Here is our monthly price, take it or leave it. We hope you will take the risk -- and be satisfied enough that you will continue this game.

to:

We will reduce the risk and let you help decide the fair price after each month’s use -- but we will continue this game (beyond a few trial cycles) only if we agree that you are being reasonably fair.

The logic of the FairPay game is that

each customer pays for what that customer values, within limits of fairness that the business can accept. Thus each customer decides what social responsibilities they are willing to pay for. They vote with their wallet, and the business collects those votes as dollars going into their bottom line.

So, with a new logic like this, how can we hack Milton Friedman's concerns about social responsibility? Consider these examples that address the growing trend toward digital and experience goods that cannot be effectively valued until after they are purchased and used:

- A digital newspaper lets readers subscribe and decide what to pay after each month of use. It reminds them what they read, what writing those stories cost per reader, and what share of its revenue goes to the reporters and investigative expenses. It reminds them of how its recent reporting benefited the community and the prizes earned. It lets readers pay bonuses specifically to reporters they wish to support. (A non-profit Guardian might accept any level of fairness, but a for-profit New York Times might warn a reader who it thinks is being repeatedly unfair that it will shunt them back to a conventional set-price subscription unless they meet higher standards of fairness.)

- An online retailer of furniture lets established customers pay for items in two stages, first, at-sale, to cover the marginal costs of the items (and perhaps a small profit margin), then, after it has been experienced for a month, with an added bonus that reflects the customer’s perceived value of the purchase, plus the perceived value of the business’s employment, sourcing/curation, and sustainability practices. (Again, customers it deems to be repeatedly unfair might be shunted back to standard set prices.)

In each of these cases the business has a dialog with customer in which price relates to value received. The customer has co-equal power to define

what aspects of value matter.

- For the newspaper, value is not just how many weeks the subscription was accessible, or how many stories were read, but whether those stories had real value, what costly investigative journalism or analysis was done, how much was paid to valued reporters, what community values were supported, what waste was prevented, and the like. Some of these "social" values might be segregated to be paid for with explicit "bonus" payments to these other stakeholder categories. To the extent customers value those elements by paying for them, that is no longer "taxation without representation" as Friedman claimed. (See operational details for this example.)

- For the retailer, value is not just the raw utility of an item, but the quality and style of design, the conditions for employees and at supplier factories, support of local and source communities, environmental practices, and the like. Again, these could be identified as "bonus" payments and again, "taxation" voluntarily paid. (See operational details for this example.)

[Update 8/28/19>] Examples of discrete social responsibility offers to customers

This can get richly nuanced, but to clarify how these SRaaS offerings can be made discrete and easy for individual customers to opt in (or not), at whatever level they choose, consider these simple forms of SRaaS offers:

- Would you be willing to pay an extra $4 for environmentally-friendly, biodegradable packaging and no-fossil-fuel shipping?

- Matching grant: Would you be willing to pay an extra $1, $5, or $20 (select amount) to fund on-the-job training for ex-coal miners who seek to upgrade their skills to work in our factory in Appalachia, if we match your grant dollar for dollar? [revised 9/3]

- Do you want to rank your product search results 1) by price alone, 2) by price weighted by ESG score, or 3) by ESG score alone?

- Do you want to filter your product search to require an ESG score of greater than 1, 2. or 3 stars?

Just like any other product pricing, packaging and bundling decision, such offers can be put to the customers as a menu of options. A business can start with a few narrow trials with selected segments of customers with a propensity to support social responsibility -- to begin this new kind of cooperation, and then grow from there. (The specifics of such offers and the corresponding usage of funds can be validated to customers with independent impact certifications and metrics, very much as is now being demanded by impact investors.)

[See further update 9/3 on matching funds, below.]

The invisible handshake -- one-to-one markets for social responsibility

Increasingly, businesses will earn premium profits by catering to customers' desires to support social responsibility. Customers who cannot afford to pay such premiums could be supported by more affluent customers who see that as their duty to support, not only for themselves but for those less fortunate. (Those who could pay but refuse to might be shunted to set-price models -- FairPay can be offered as a revocable privilege.) Some businesses will cater to the segment of recalcitrant customers who refuse to allocate any of their wallet to that kind of social responsibility, but the profit margins for doing so will be smaller.

(Further detail on FairPay is here, including a variety of use cases, and discussion of how and where to start, and how to grow from there.)

Instead of exhorting managers and shareholders to pay out of the customers' wallets for competing social benefits that that the managers have no clear basis to decide among (and perhaps in conflict with their legal fiduciary duty), we should be exhorting customers to pay from their own wallets for the social benefits they want to support.

If we do that, we may solve 80% of the problem, and do it with high market efficiency, leaving just the remaining 20% to be addressed by regulatory protections.

The greatest danger in times of turbulence is not the turbulence, it is to act with yesterday's logic.

-- Peter Drucker

------------------------

[*UPDATE 8/27/19:] Terminology: agency vs representation

My original use of the term "agent," now replaced by "representative," may have been too strong and loaded with issues, for reasons outlined in the 2017 HBR article, The Error at the Heart of Corporate Leadership. I now use "representative," to make it clear that it is the possibly contingent role as a representative of an interest, whether as agent, fiduciary, or otherwise, often in balance with other interests, that I refer.

The relevant thrust of my argument is that managers are naturally driven by financial incentives to themselves and to the shareholders they serve (in whatever legal capacity) in the calculus of their decision-making and allocation of resources. The surplus of the revenue they take in, net of costs and reinvestment, goes to the shareholders. The revenue comes from the customers. One can shift from agency theory to entity theory and broader views of roles and constituencies to be served, but the question remains -- what objective function are boards and managers to maximize in each resource allocation decision? I suggest that rather than an undifferentiated mix of interests to be balanced in vaguely defined ways, the best claim to a vote generally goes to the customer (especially when the customers are a broad base of consumers). That argument may be situation dependent, and market forces may to some extent enable the votes of other stakeholder constituencies to be quantified into bottom line terms. But it is usually customers who have by far the clearest bottom line market power with respect to each business -- it is customers that businesses must increasingly listen to.

Thus it seems both desirable and practical that primacy of the customer in driving a market calculus for resource allocation will be the best way to manage allocations of resources to all forms of social responsibility. My argument is that we need to get far more systematic and granular in getting the customers to vote with their wallets on all of those allocation decisions. That is not at odds with efforts to quantify effects on other stakeholders -- it is supportive of them, in that a customer-driven social value calculus is the most practical driver for the balancing of other social value quantification efforts. We are already moving to customer-driven enterprise -- this just applies that driving force to social responsibility.

This HBR article notes that the key weakness to company/entity-centered governance is "complex relationships and responsibilities; success is difficult to assess." What I suggest here is a new and sensible way to balance those responsibilities and to assess success at the bottom line.

[UPDATE 8/28/19:] Social responsibility down the value chain - B2B2C

While this was written with primary focus on B2C companies, it should be understood that it applies equally to B2B2C.

B2B business is primarily driven by homo economicus

, but the ultimate customer of B2B businesses is usually a customer in a B2C relationship. Consumers want social responsibility down their supply chain, so that implies a corresponding social responsibility chain. B2C businesses will want to be able to demonstrate that social responsibility to their customers, and so their B2B suppliers will need to demonstrate that social responsibility along each step in their chain so they can pass it up the chain to their consumers. Sounds complicated, but not really very different from any supply chain value issue.

[UPDATE 9/3/19:] Matching funds, for new leverage in CSR

An important variation on the above suggestions for customer-funded CSR is to add a "matching funds" feature. To offers to facilitate CSR efforts like this one suggested above...

- Matching grant: Would you be willing to pay an extra $1, $5, or $20 (select amount) to fund on-the-job training for ex-coal miners who seek to upgrade their skills to work in our factory in Appalachia, if we match your grant dollar for dollar? [as revised 9/3]

...the business could make a matching funds offer: "We will put in $1 for every $1 you put in."

This has two significant benefits:

- It explicitly shares in the cost. Instead of putting all of the burden on the customer to fund such efforts (and even possibly taking a profit margin out of that, as suggested above), the business may invest some of its own funds. That would be a "tax" on the shareholders only to the extent that it is not recouped in higher profit margins, and only for efforts that the customers signal with their wallets that they really care about. (That results in high likelihood that the investment will lead to higher profits as well as greater social welfare, so it is less likely to really be a "tax.")

- It motivates the customer to contribute. Matching funds are accepted as effective practice in charitable and political fundraising, and have also been proven to motivate pay what you want business payments (see the Gneezy paper in my Resource Guide). This brings clear business-customer cooperation to directing and funding CSR efforts.

Matching gift programs are widespread for business-employee cooperation, but I am not aware of similar efforts to enable business-customer cooperation in directing and funding CSR. Why not adapt that already proven model to this most important stakeholder?

------------------------

More about FairPay

(FairPay is an open architecture, in the public domain. My work on FairPay is pro-bono. I offer free consultation to those interested in applying FairPay, and welcome questions.)